oregon college savings plan tax deduction 2018

Compare 2022s Most Recommended Tax Relief Companies that Can Help You Save Money. Itemized deductions for Oregon.

The Best 529 Plans Of 2022 Forbes Advisor

529 college savings plan subtraction.

. If you plan on claiming the Working Family. The 2017 tax reform package expanded 529 plan benefits to include tax-free withdrawals for private public or religious elementary middle and high school tuition. Tax benefits available.

Biden has proposed increasing the corporate income tax rate from the 21 level in effect since 2018 to 28. All Available Prior Years. All Available Prior Years.

Ad File Late Taxes Today With Our Maximum Refund Guarantee. A 28 tax rate would be significantly lower than the top corporate. The money deposited into.

Ad Explore Our Recommendations for 2022s Top Tax Relief Companies. And a Checking Investment option that. A health savings account HSA is a tax-advantaged savings account available to people enrolled in a high-deductible health plan.

Annual gift tax exclusion. A Bank Savings option. May not be combined with other.

The Plan offers five investment options to best suit your needs. 3 mutual fund options Growth Moderate and Conservative. More on HSA deduction rules.

Born May 3 1949 is an American politician and retired educator serving as the senior United States senator from Oregon a seat he has held since. Ronald Lee Wyden ˈ w aɪ d ə n. One of the many benefits of saving for a childs future college education with a 529 plan is that contributions are considered gifts for tax purposes.

Free prior year federal preparation Prepare your 2018 state tax 1799. Oregon tax credits youll be claiming. Ad File Late Taxes Today With Our Maximum Refund Guarantee.

Get a Free Consultation. Bloomberg Industry Group provides guidance grows your business and remains compliant with trusted resources that deliver results for legal tax compliance government affairs and. Free prior year federal preparation Prepare your 2018 state tax 1799.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. For Oregon taxpayers only up to 150 annual tax credit for single filers and 300 for joint filers depending on annual plan contribution and income.

Edvest Wisconsin 529 College Savings Plan Ratings Tax Benefits Fees And Performance

529 Plans Without The Fossil Fuels Alternative Energy Stocks

How Does The Secure Act Affect 529 Plans

Can You Use A 529 Plan To Pay For Study Abroad

529 Plan Deductions And Credits By State Julie Jason

Gifting Faqs Oregon College Savings Plan

Oregon Won T Allow 529 Tax Breaks For K 12 Private School Oregonlive Com

6 Of The Best Educational Email Templates For Higher Ed Marketers Best Email Education Email Marketing Software

529 Plan Advertisements And Marketing Collateral

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Information On 529 Plans Turbotax Tax Tips Videos

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

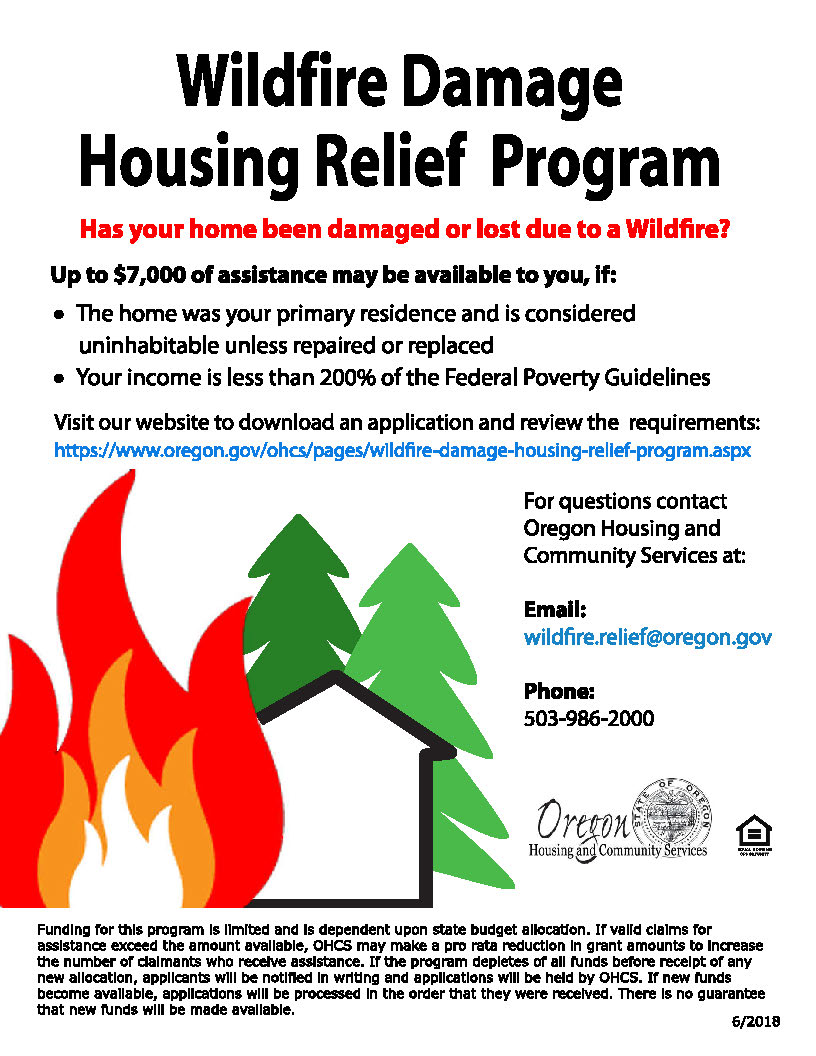

Wildfire Housing Relief 529 Savings Plan Updates State Fair More

:max_bytes(150000):strip_icc()/ScholarShare529CollegeSavingsPlan-2672c84cb23f47ba9257a8efdb00ed8f.jpg)

:max_bytes(150000):strip_icc()/PrivateCollege529Plan-0408a91482914cfb957348bfc19dd36b.jpg)